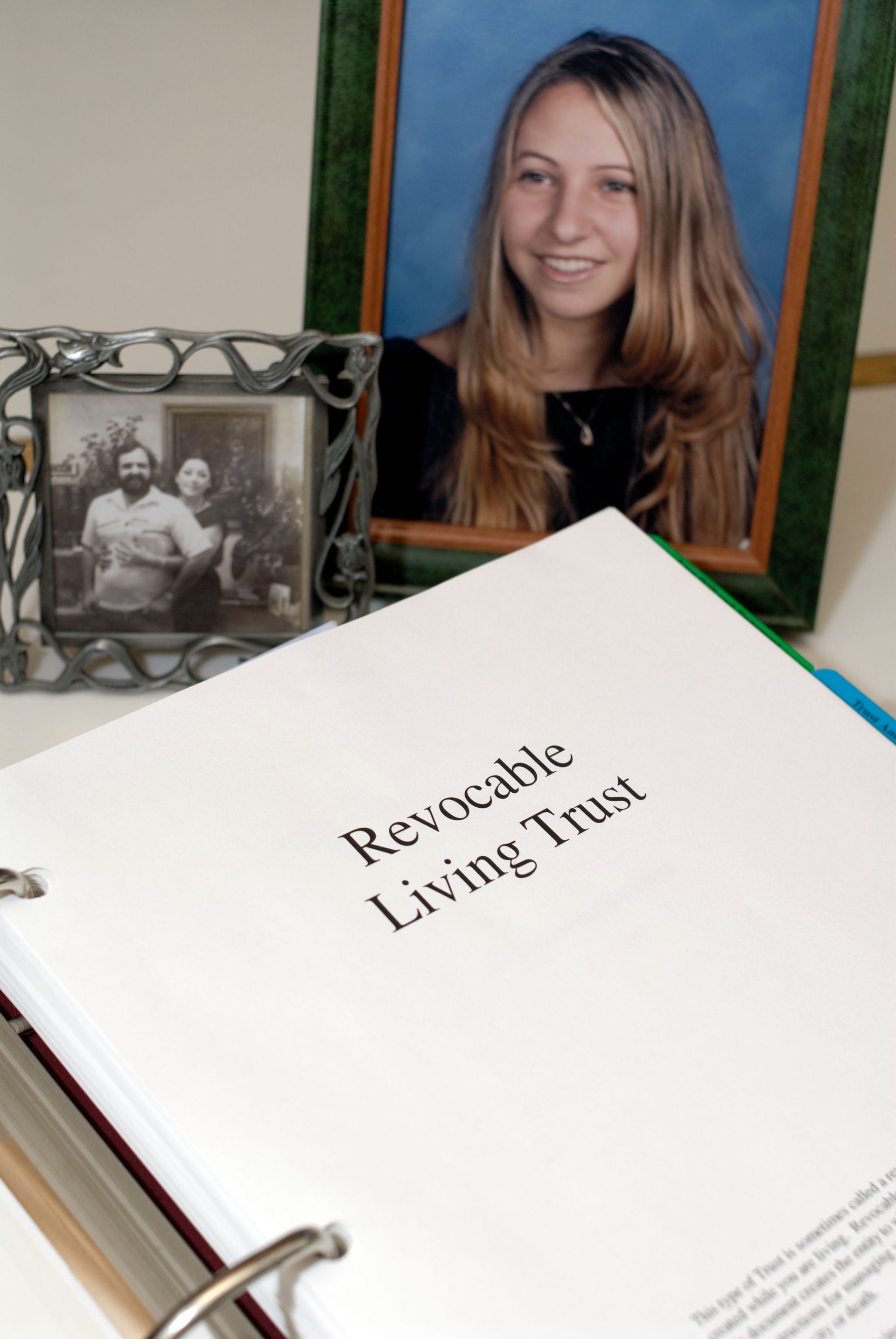

10 Things to Know about Setting up a Revocable Living Trust in Florida

A trust or living trust is a legal document created by a person during his/her lifetime to control how their assets will be managed upon death via a trustee. Living trusts make it easy to transfer an individual’s assets without costly and expensive legal processes like probate.

A revocable living trust can be defined as a trust whose provisions can be canceled or altered depending on the originator of the grantor of the trust. Besides avoiding probate, revocable living trusts in Florida also help to prevent guardianship court. They also give a person control over their assets after death and protect persons with special needs.

Given the importance of a revocable living trust, how do you set up one in Florida? What should you know beforehand? Below are ten considerations to guide you.

Transfer Florida homestead to revocable trust & other essential considerations when transferring property/setting up a revocable trust in Florida

1. Consider individual vs. shared trust

Individual trusts have property that a person owns individually. Shared trusts have property owned individually and jointly. If you have property you co-own with someone, i.e., a spouse, and intend to leave most/all your property to each other, you should consider a shared trust. You can opt for an individual trust if you own little to no property jointly or recently married. Individual trusts also make more sense for individuals who acquired most of their property separately before marriage.

2. Decide what property to include

One of the sole purposes of a revocable living trust is avoiding probate fees. Generally, probate fees increase as the number of assets in the trust increase. But since revocable trusts avoid such fees, you should include your most valued possessions in the trust.

Generally, you should include property you expect to have for a lifetime, such as real estate, stocks, and other security accounts, copyrights and patents, precious metals, and valuable art, antiques, or other collections like coins and stamps.

3. Selecting a successor trustee

You need a successor trustee to set up a living trust. This decision is critical since successor trustees are persons who take over a trust’s assets upon death or incapacitation of a trustor or grantor (the person who sets up the trust).

Generally, people put spouses, grown children, or their close friends as successor trustees. However, you should consider the suitability of the individual in mind. For instance, can your spouse handle the task of managing your property? If you have many children, who should you select? Are lawyers or trust companies better successor trustees? What about having your children as co-trustees. Will they get along?

If you have questions about making typical selections, i.e., choosing a child or spouse, a corporate trustee is better. However, beware of the extra cost and other implications.

4. Who will get the trust property?

When setting up a revocable living trust in Florida, you’ll also need to think about the trust’s beneficiaries. You can assign beneficiaries to each item separately or name a single beneficiary of everything. It’s worth noting that beneficiaries aren’t entitled to any asset/property before you die. Moreover, you can amend the trust document and change beneficiaries as you wish.

In case you don’t want to leave 50% or more of your property to your spouse, you may need professional estate planning to make an informed decision. Spouses may be entitled to property in living trusts. What’s more, individuals planning on disinheriting their children for whatever reason should consider making a will and mentioning clearly which child is entitled to what.

5. Creating a trust document

You’ll normally need legal help when creating a revocable living trust in Florida. While it’s possible to do it yourself, a lawyer is important if you have questions about specific scenarios or pressing estate planning issues that typical living trusts wouldn’t solve.

Since trust documents are legal documents resembling articles of incorporation created by corporations and governed according to bylaws, a trust agreement should be drafted by a lawyer. While trusts may not be considered to be legal entities like corporations that pay taxes, get into contractual agreements, or get sued, lawyers can offer valuable advice on special circumstances like divorce, amendments, state laws applicable to property, etc.

6. Signing a trust document in the presence of a Notary Public and Witnesses

While it’s not a requirement for a trust document to be signed in front of a Notary Public, it’s advisable to do so. A Notary Public’s sole responsibility is ensuring that documents signed and the person signing are whoever they purport to be. This step is critical for eliminating common issues on forgery. It offers authorization guarantees to every party involved, i.e., those who have signed were of sound mind, and the signatures in the document are genuine. Witnesses would be required for the testamentary aspects of the trust to be valid.

7. Changing title to trust property

It’s vital to change titles of any trust assets/property with a title document such as houses to reflect the correct ownership, i.e., you now own the assets as a trustee. The agent or trustee with the responsibility of managing property in a revocable living trust is the only party that can change title to assets in a trust. Titles to property transfer to trustees of a living trust to allow smooth movement of property should you choose to sell property attached to the trust while you are alive.

8. Storing a revocable living trust

Once a revocable living trust is completed and signed, an original copy of the executed trust should be stored safely by any party involved, i.e., beneficiaries, trustees, and grantors. Unlike wills, you don’t need to register a revocable trust or have it signed by a government office. The trust is solely held by involved parties.

9. Revoking a living trust

You can change your mind after setting up a revocable living trust. If this happens, you can terminate a revocable trust in Florida at any time by first re-establishing or re-titling all listed property as your property. Since all property under a trust is the trust’s property and not a person’s property, it must be transferred to the original owner.

You also need to file a revocation of the living trust. The revocation should be dated and signed in front of a notary public. It should also have a witness who isn’t a trustee.

10. Setting up a pour-over will alongside a revocable living trust

Pour-over wills exist to direct assets to a trust. They can be considered alongside revocable living trusts to include everything in case you pass on with probate assets even after transferring property to a living trust. A pour-over will acknowledge a revocable trust. The will should be consistent with the language of the revocable trust. It also nominates persons in line to act as executors or trustees with a similar structure for alternates.